The chart shows an estimate of how much an investment could grow over time based on the initial deposit, contribution schedule, time horizon, and interest rate specified. Changes in those variables can affect the outcome. Reset the calculator using different figures to show different scenarios. Results do not predict the investment performance of any Acorns portfolio and do not take into consideration economic or market factors which can impact performance.

Claim your $5 $20 bonus investment

Easy investing for the growth-minded

Compound Interest Calculator

An expert-built, diversified portfolio recommended for your money goals base on your investor profile.

An expert-built, diversified portfolio recommended for your money goals base on your investor profile.

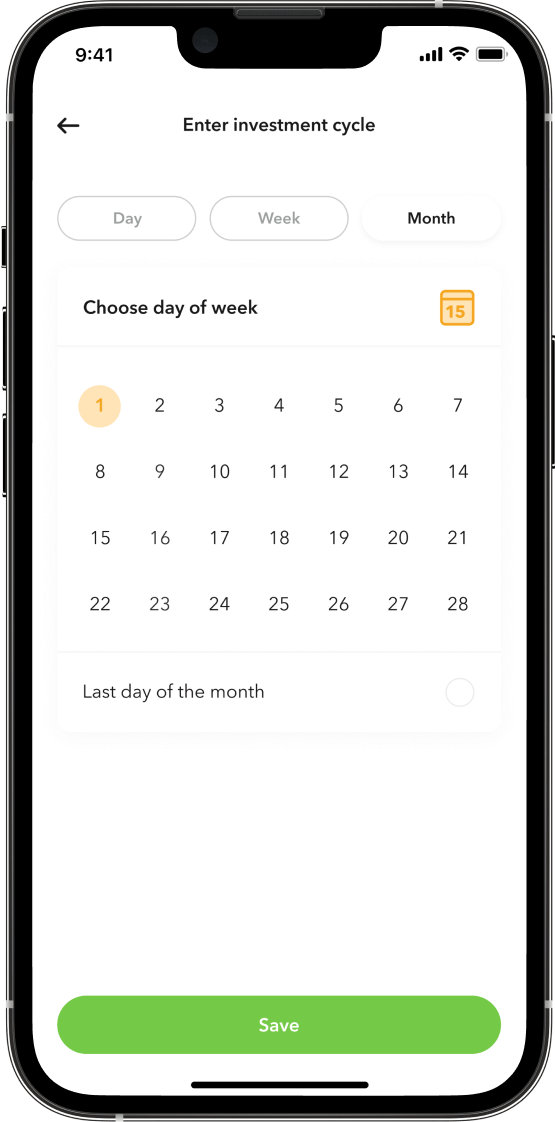

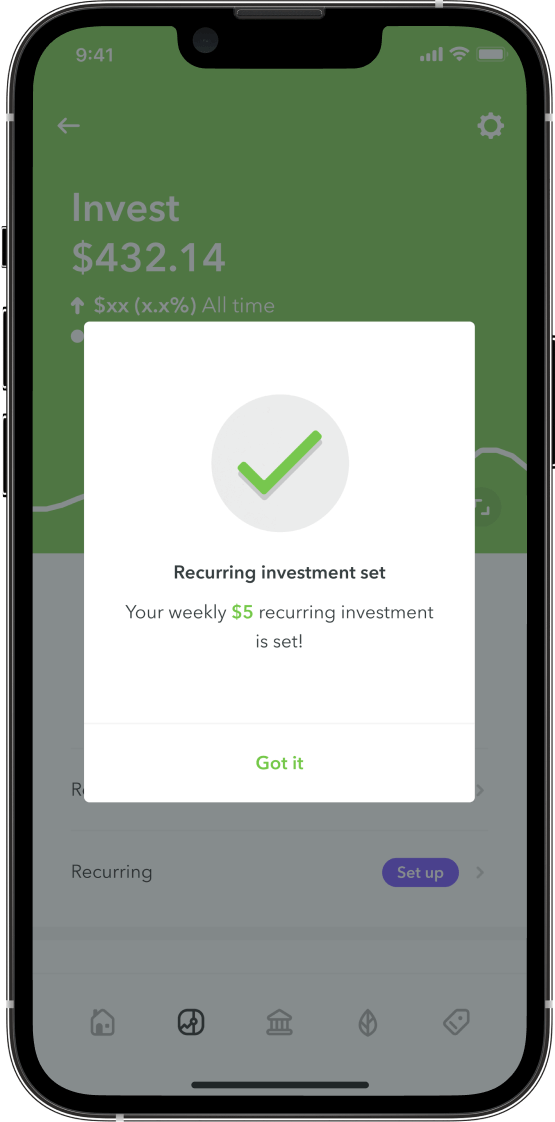

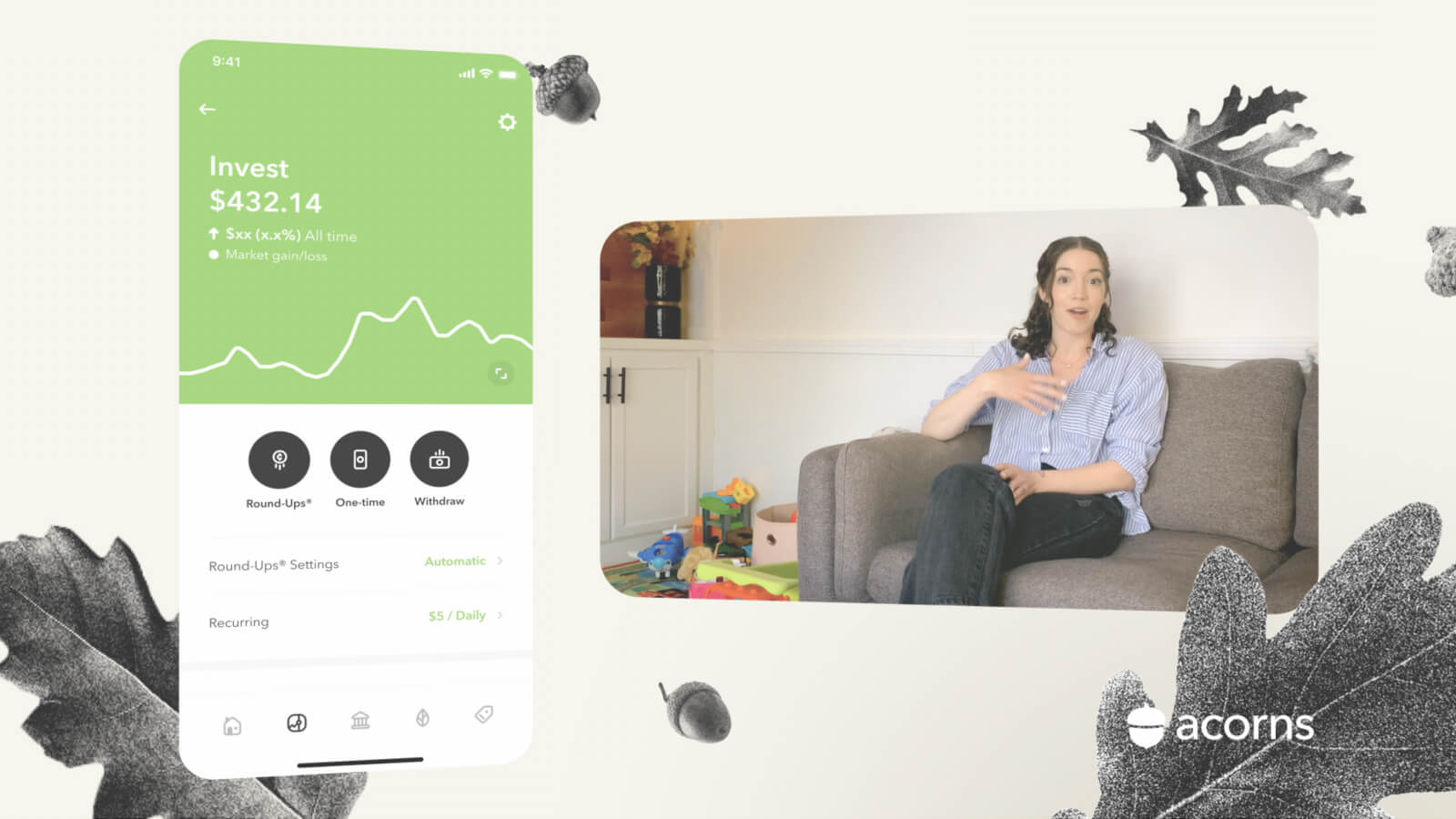

Put your investing on autopilot with a $5 daily, weekly, or monthly Recurring Investment.

Put your investing on autopilot with a $5 daily, weekly, or monthly Recurring Investment.

Automatically invest spare change from your everyday purchases with Round-Ups®.

Automatically invest spare change from your everyday purchases with Round-Ups®.

Create investment accounts for each of the kids in your life.

Create investment accounts for each of the kids in your life.

Use Acorns Early Invest account funds for ways that directly benefit your kid — not just on education.

Use Acorns Early Invest account funds for ways that directly benefit your kid — not just on education.

Get potential tax advantages while you invest for the kids you love.

Get potential tax advantages while you invest for the kids you love.

Auto-invest for retirement in an IRA portfolio that auto-updates as you age.

Auto-invest for retirement in an IRA portfolio that auto-updates as you age.

Set easy, automatic Recurring Contributions, starting at $5 a day, week, or month.

Set easy, automatic Recurring Contributions, starting at $5 a day, week, or month.

Take advantage of potential tax benefits while you invest for your golden years.

Take advantage of potential tax benefits while you invest for your golden years.

Open a checking account that automatically saves and invests a piece of your paycheck for you.

Open a checking account that automatically saves and invests a piece of your paycheck for you.

Instantly invest your spare change with every swipe of your Acorns debit card.

Instantly invest your spare change with every swipe of your Acorns debit card.

No minimum balance or overdraft fees. Plus, 55,000+ fee-free ATMs within the AllPoint Network.

No minimum balance or overdraft fees. Plus, 55,000+ fee-free ATMs within the AllPoint Network.

Acorns is a member of SIPC. Securities in your account are insured up to $500,000. For details, please see www.sipc.org.

Acorns is a member of SIPC. Securities in your account are insured up to $500,000. For details, please see www.sipc.org.

Acorns checking accounts are FDIC-insured up to $250,000 through Lincoln Savings Bank or nbkc bank, Members FDIC

Acorns checking accounts are FDIC-insured up to $250,000 through Lincoln Savings Bank or nbkc bank, Members FDIC

Keep your information safe with 256-bit data encryption and fraud protection.

Keep your information safe with 256-bit data encryption and fraud protection.

No worries.

Frequently asked

How does Acorns work?

Acorns was built to give everyone the tools of wealth-building. Whether you’re new to investing or planning ahead for your family’s future, we bundle our products, tools, and education into subscription plans — each curated to meet you on whichever stage of life you’re in.

Acorns offers three different subscription plans for your life’s financial needs.

Acorns Bronze - $3/month

Investing tools and financial education to get started. This plan includes:

- Invest

- Later

- Checking

Acorns Silver - $6/month

Tools to learn, save and invest, plus live Q&A sessions with financial experts. This plan includes the previous tools, in addition:

- Premium Education

- Emergency Fund

- Earn Rewards Match (eligible for an extra 25% match on bonus investments you earn up to $200.)

- Mighty Oak Card

Acorns Gold - $12/month

Full suite of tools to save and invest for your family. This plan includes the previous tools, in addition:

- Benefits Hub

- Custom Portfolio

- Early

- Earn Rewards Match (eligible for an extra 50% match on bonus investments you earn up to $200.)

- Mighty Oak Card

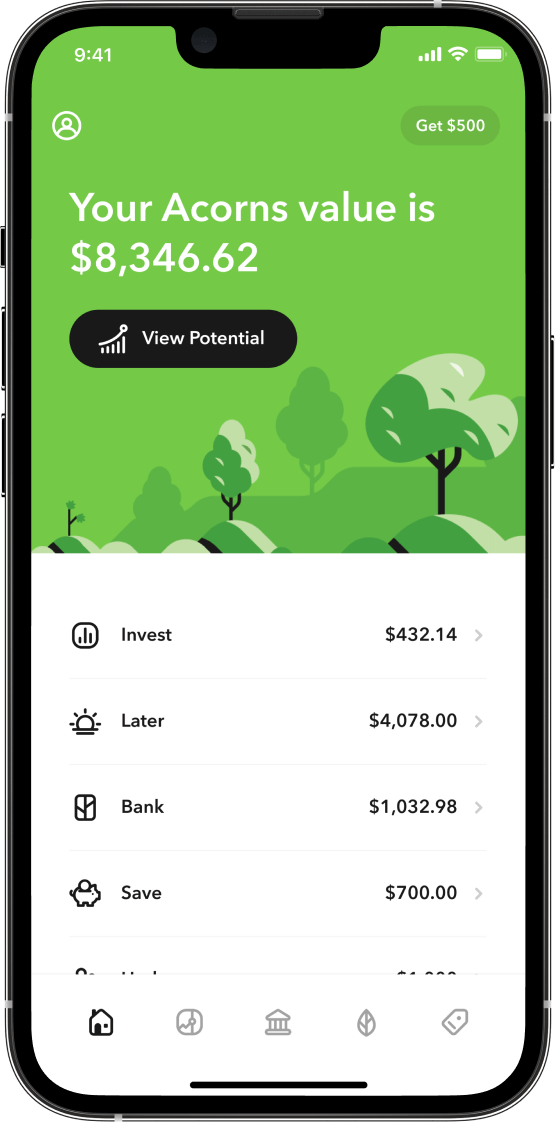

What are the different accounts in the plans?

Invest automatically invests your spare change (if you opt-in) and lets you invest as little as $5 any time or on a recurring basis into a portfolio of ETFs. Your investments are then diversified across more than 7,000 stocks and bonds, and Acorns automatically rebalances your portfolio to stay in its target allocation.

Later, the retirement account, lets you automatically save for retirement by setting easy Recurring Contributions. When you sign-up, the app recommends an IRA account for you based on your goals, employment and income.

With Acorns Checking, our checking account and debit card, you can save, invest and earn while you spend. Acorns Checking has no overdraft or minimum balance fees, plus free Allpoint ATM access nationwide.

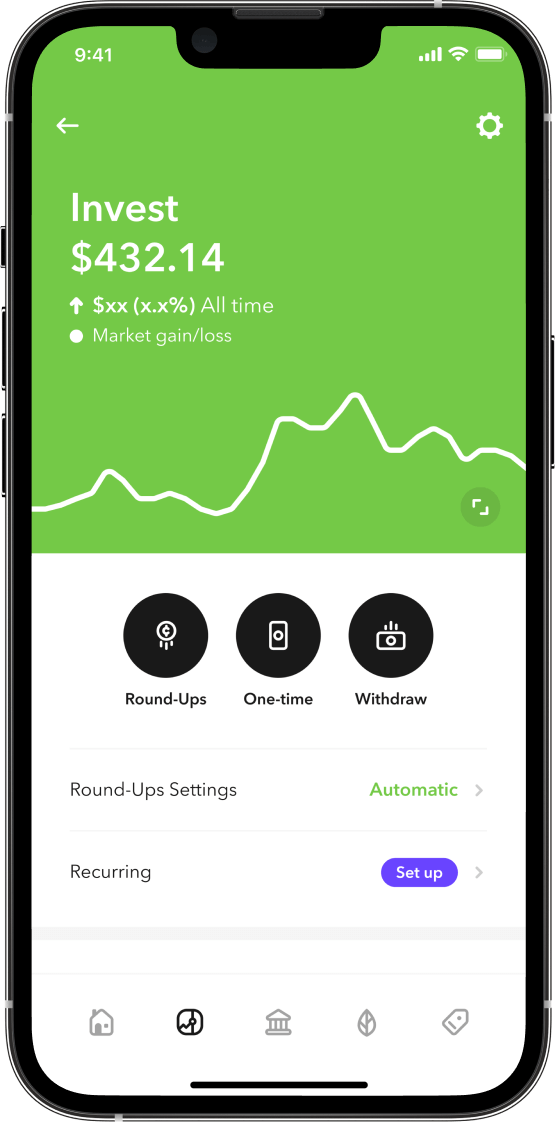

Round-Ups® and Investing

With Round-Ups®, we round up any purchase made from a linked account, debit or credit card to the next dollar. We invest Round-Ups® in your Acorns Invest account when they add up to at least $5 from all linked accounts. You can find and manage your Round-Ups® within your Invest account.

Round-Ups® will always be transferred from your primary checking account.

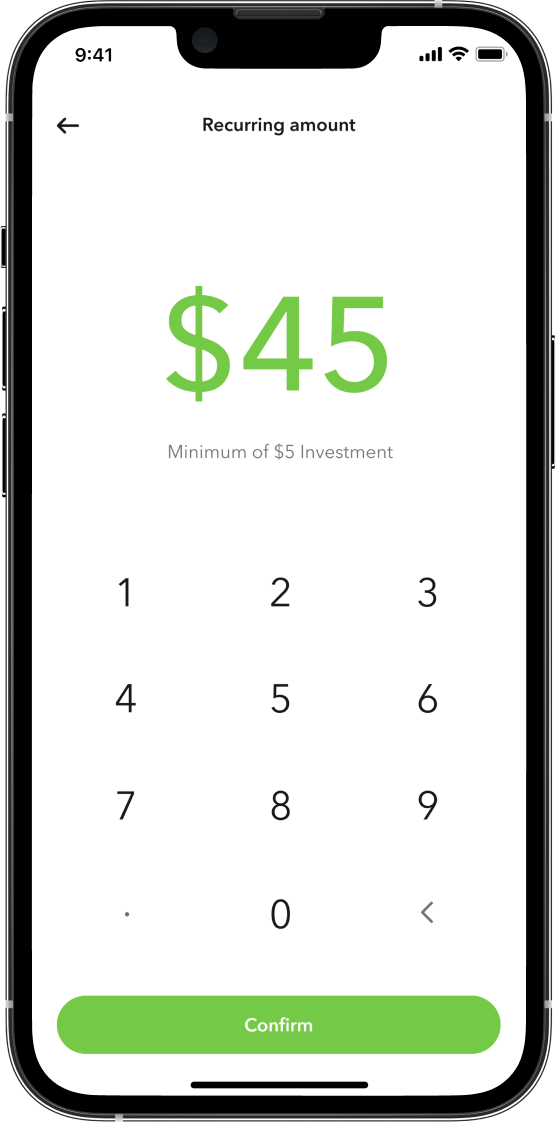

Recurring Investments allow you to invest as little as $5 per day, week or month into your Acorns accounts.

And you can make one-time investments anytime to boost your account value. When you create your profile, we'll suggest a portfolio based on your answers to a few questions, but you can change it at anytime. The portfolio recommendation is designed with the goal to maximize potential returns at a selected level of risk.

Where do we invest it? The money in your Acorns Invest account is invested in different exchange-traded funds (ETFs). These funds include stocks, bonds and other securities. Read more about it at acorns.com/invest.

What makes Acorns different?

Our 5 investment portfolios were designed with the goal to maximize potential returns at a selected level of risk. There are no account minimums and we don't work on commission. Our goal is to give you the tools to take the best financial care of yourself, easily.

For our low monthly fee, you get:

- Diversified portfolios

- Automatic rebalancing

- Access to Acorns Earn partners to earn while you shop

- On the go accessibility through our mobile and web app

- Investment support from our dedicated support team

- Access to Acorns Later, an easy way to save for retirement

- Access to Acorns Checking, with a debit card that saves, invests and earns for you

The path to financial wellness should be accessible to everyone, so we make it easy to invest in you. With Acorns, you can start early and invest often, without making big changes to your everyday life. In fact, you can start with as little as $5.

What do I need to get started?

Once you download the Acorns app or sign up through our web app, you’ll need:

- A valid email address where we can reach you and regularly send you account information.

- Your online banking log-in information to link your accounts to fund your investments and use Round-Ups®. (Please note, you MUST be listed as an owner on the bank account)

- Your physical address - this should be your most permanent address since we can't accept a PO Box or business address. (Please note- you will be able to designate a different mailing address if needed)

- Your Social Security Number or ITIN.

- General Profile Information like your financial goals, occupation, and earnings. This will help us recommend the right portfolio for you.

After signing up, you may also need to upload a photo of your government-issued ID or other documentation that allows us to verify your identity.

That’s it! Most accounts are approved within 1 business day. If you experience a delay in getting your account approved, please reach out to Support.

Where is my money invested?

There are five different Acorns Core portfolios and four different Acorns ESG Portfolios, built by experts. Each portfolio is composed of exchange-traded funds — ETFs for short. An ETF is made of broad holdings of stocks and/or bonds. Depending on your portfolio, you’re invested in a mix of companies, markets, and bonds—and if you choose, a Bitcoin-linked ETF. The overview or prospectuses of the ETFs can be found below:

- Large Company – VOO

- Medium Company Stocks – IJH

- Small Company Stocks – IJR

- International Company Stocks – IXUS

- Short Term Bonds – ISTB

- US Aggregate Bonds – AGG

- iShares ESG Aware MSCI USA ETF | ESGU

- iShares ESG Aware MSCI EM ETF | ESGE

- iShares ESG Aware MSCI USA Small-Cap ETF | ESML

- iShares ESG Aware 1-5 Year USD Corporate Bond ETF | SUSB

- iShares ESG Aware MSCI EAFE ETF | ESGD

- iShares 1-3 Year Treasury Bond ETF | SHY

- iShares MSCI USA ESG Select ETF | SUSA

- iShares U.S. Treasury Bond ETF | GOVT

- iShares MBS ETF | MBB

- iShares ESG Aware USD Corporate Bond ETF | SUSC

- Proshares Bitcoin Strategy ETF - BITO

- Shares Short Treasury Bond – SHV

- SPDR Bloomberg Barclays 1-3 Month T-Bill – BIL

- Goldman Sachs Access Treasury 0-1 Year – GBIL

- JPMorgan Ultra-Short Income – JPST

- iShares Ultra Short-Term Bond – ICSH

If you have any other questions, feel free to reach out to us here.

Important Disclosures

Welcome to the Acorns site, operated by Acorns Advisers, LLC ('Acorns'). To be eligible for this offer, you must be a first-time Acorns customer and have an account in good standing at all times between signup and the date the bonus is invested is made to your Acorns Invest Account. You must make a successful investment via the Recurring Investment feature (minimum of $5) within the first 5 days of the month following the month in which your Acorns account was verified. Bonuses will be invested into your account within 5 weeks of meeting offer qualifications. Acorns is only offered to US-residents who are 18 years of age or older. Acorns reserves the right to restrict or revoke this promotional offer at any time and without notice.

Over 14 million all-time customers and over $25 billion invested since inception as of 12/4/2024. App store star rating as of 12/2/2024.

More information about Acorns Advisers is available in the wrap fee program brochure, and our customer relationship summary.

© 2025 Acorns

Important Risk Disclosures

Investing involves risk, including loss of principal. Please consider, among other important factors, your investment objectives, risk tolerance and Acorns’ pricing before investing. Acorns Subscription Fees are assessed based on the tier of services in which you are enrolled, view details in our program agreement. Investment advisory services offered by Acorns Advisers, LLC (Acorns), an SEC-registered investment advisor. Brokerage services are provided to clients of Acorns by Acorns Securities, LLC, an SEC-registered broker-dealer and member FINRA/SIPC.

Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principle. Compounding is the process in which an asset's earnings are reinvested to generate additional earnings over time. It does not ensure positive performance nor does it protect against loss. Acorns clients may not experience compound returns and investment results will vary based on market volatility and fluctuating prices.

Spare change invested with Round-Ups® is transferred from your linked funding source to your Acorns Invest account, where the funds are invested into a portfolio of selected ETFs. If you do not maintain an adequate amount of funds in your funding source sufficient to cover your Round-Ups® investment, you could incur overdraft fees with your financial institution. Round-Up investments from an external account, will be processed when your Pending Round-Ups reach or exceed $5.

The average Acorns investor, with a verified and active account, has invested $166 between 1/1/21 and 4/30/21 using the Round-Ups® feature. Individual results will vary and averages only take into account the Round-Ups® investments themselves and do not reflect the impact investment volatility will have on overall performance.

Acorns Invest is an individual investment account. Acorns Later is an Individual Retirement Account (either Traditional, ROTH or SEP IRA) selected for clients based on their answers to a suitability questionnaire. Invest and Later recommend a portfolio of ETFs (exchange traded funds) to clients, please note that a properly suggested portfolio recommendation is dependent upon current and accurate financial and risk profiles.

Acorns is not a bank. Acorns Visa™ debit cards and banking services are issued by Lincoln Savings Bank or nbkc bank, members FDIC. Acorns Checking clients are not charged overdraft fees, maintenance fees, or ATM fees for cash withdrawals from in-network ATMs.

Acorns Earn provides subscribers access to shop with our partners and earn bonus investments into your Acorns Invest portfolios when purchasing items from the partner brands. Acorns Earn rewards investments are made by Acorns Grow, Inc. into your Acorns Invest account through a partnership Acorns Grow maintains with each Acorns Earn partner.

Acorns, Round-Ups® investments, Real-Time Round-Ups® investments, Invest the Change and the Acorns logo are registered trademarks of Acorns Grow Incorporated. All product and company names are trademarks™ or registered® trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

For additional important risks, disclosures, and information, please visit https://www.acorns.com/terms/

© 2025 Acorns Grow Incorporated | Disclosures | Accessibility | Privacy Policy | Your Privacy Choices